Willy the Hornet tree carving

Our Insurance Services

Home Insurance

Protect your home and belongings with comprehensive homeowners coverage

Auto Insurance

Michigan auto coverage with competitive rates and excellent service

Life & Health Insurance

Secure your family's financial future with life and health protection

Business Insurance

Comprehensive commercial coverage tailored to your industry needs

Workers Compensation

Required coverage that protects your employees and your business

Commercial Auto

Coverage for your business vehicles, trucks, and fleet

General Liability

Essential protection against third-party claims and lawsuits

Professional Liability

Errors & omissions coverage for professional service businesses

Trusted Insurance Carriers We Represent

And many more carriers to ensure you get the best coverage for your needs

Industries We Serve

Insurance for Every Phase of Life

New Teen Driver

Add to your policy, discount hunt, safe-driver setup

First-Time Homebuyer

Protect your investment from day one with the right coverage

Thinking About Medicare

Clear Part A/B basics + supplement or Advantage guidance

Haven't Reviewed in 2+ Years

Time for a policy checkup—rates and needs change

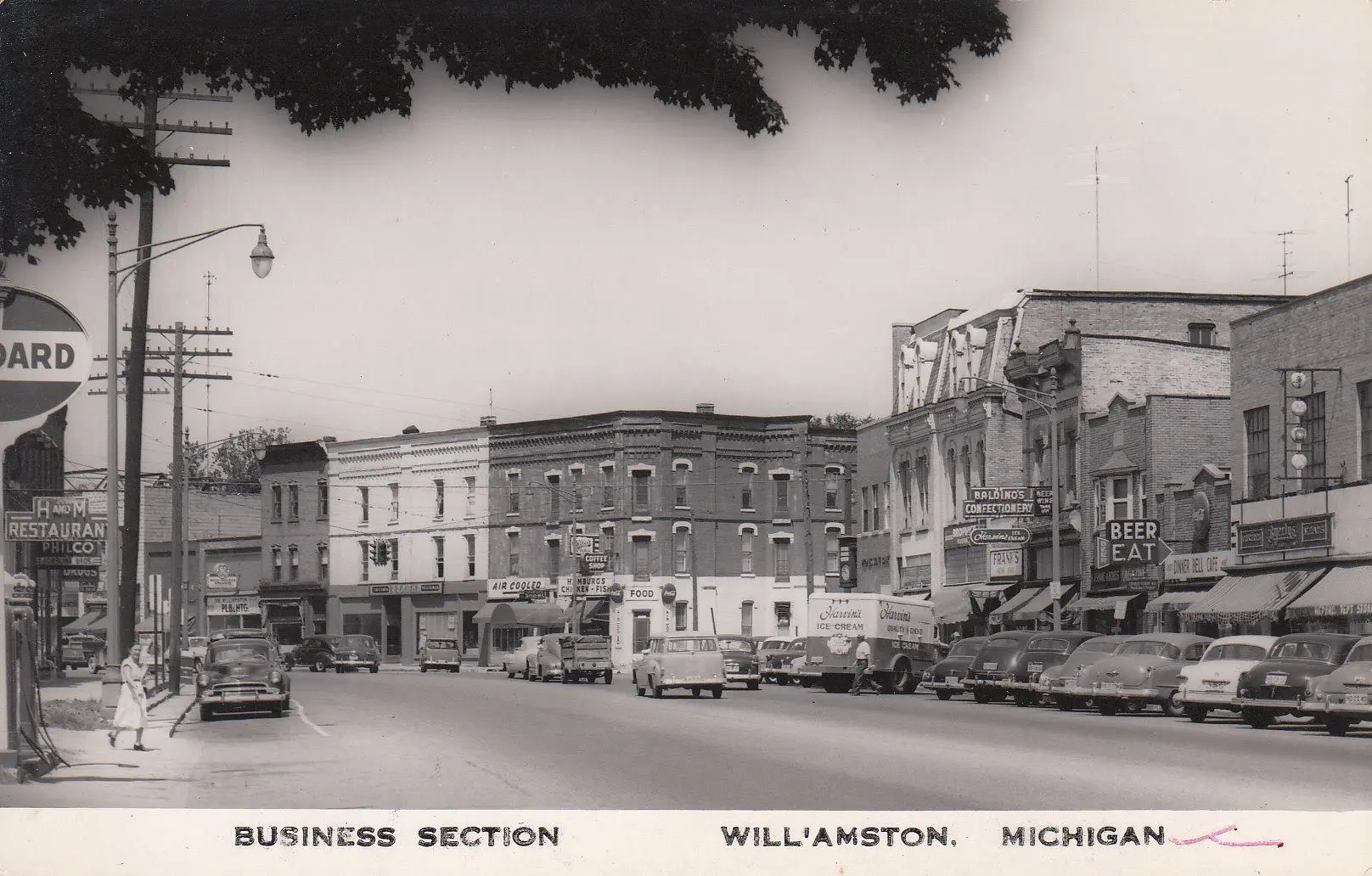

About Janus Insurance Agency

Janus Insurance Agency is a family-owned insurance agency serving Williamston and surrounding Michigan communities. We understand that insurance isn't just about policies and premiums—it's about protecting the people and things you care about most.

As your local insurance partner, we take the time to understand your unique needs and craft coverage solutions that truly fit your life. Our commitment to exceptional service and local expertise has made us a trusted name in the community.

Today, we're proud to serve hundreds of families and businesses across Michigan, offering everything from home and auto insurance to comprehensive business coverage.

Integrity

Honest, transparent advice always

Community

Invested in our neighbors

Service

Exceptional care every time

Expertise

Years of insurance knowledge

Meet Your Local Insurance Experts

Jason Janus

Co-Founder

Jason Janus founded the agency in 2011 after serving 12 years in the Marine Corps, bringing military discipline and commitment to Michigan insurance. He leads with a simple philosophy: insurance should be straightforward, honest, and tailored to each client's unique situation. Under his leadership, the agency has grown from a one-person operation to a trusted local resource, renamed Janus Insurance Agency in 2014 to better reflect their family-owned approach. Jason focuses on strategic growth and carrier relationships, ensuring the agency can offer comprehensive coverage options while maintaining their signature personal service. His background informs every client interaction, whether that's helping a new business owner secure proper liability coverage or ensuring a family's home is adequately protected. For Jason, insurance isn't just about policies; it's about providing peace of mind through reliable, transparent protection.

Lisa Janus

Co-Founder

Lisa Janus co-founded Janus Insurance Agency and ensures every client receives the exceptional service they deserve. Since entering the insurance industry in 2013, she has built the client care foundation that defines our agency. Today, she focuses on developing our service team—guaranteeing your calls are answered by trained professionals, policy reviews are thorough, and claims support is both compassionate and efficient. While Jason drives agency growth and insurance expertise, Lisa maintains the operational excellence that keeps our service consistent and reliable. Her oversight means your family's protection never gets lost in the shuffle as we expand. Beyond the office, she embraces Michigan family life with Jason and their three children, keeping her connected to the real-life concerns behind every policy we write.

Lori Weed

CSR

Lori combines customer service and wellness expertise at Janus Insurance, excelling in personal and business solutions. Her client care is transformative!

What Our Clients Say

Janus Insurance made switching our business insurance so easy. They answered all our questions and got us better coverage at a lower price.

Local Contractor

Business Owner

When we had a claim, they were there every step of the way. It's nice to work with an agency that actually cares.

Williamston Homeowner

Client

Fast certificate of insurance turnaround for our jobs. They understand what contractors need and deliver.

Construction Business Owner

Commercial Client

Insurance Insights & Guides

Understanding Michigan No-Fault Auto Insurance: What Every Driver Should Know

Michigan has unique auto insurance laws. Learn how No-Fault coverage works, what PIP covers, and how recent reforms affect your rates.

Contractor Insurance Checklist: Essential Coverage for Michigan Trades

Starting or running a contracting business in Michigan? Here's your complete insurance checklist including general liability, tools coverage, and COI requirements.

Adding a Teen Driver: How to Save on Auto Insurance in Michigan

Adding a teenager to your auto insurance? Learn how to find discounts, choose the right coverage, and set up your teen for safe driving success.

Trusted by Williamston Families & Businesses

Proudly Serving Mid-Michigan

Proudly serving Williamston, Okemos, Haslett, Webberville, East Lansing, and surrounding mid-Michigan communities.

Visit Us

1041 W Grand River Ave

Williamston, MI 48895

Contact

Phone: (517) 655-1665

Email: info@janusagents.com

Hours

Monday - Friday: 9:00 AM - 5:00 PM

Saturday: By Appointment

Sunday: Closed

Response Time

Average response time: < 1 hour

24/7 Claims Support Available

Frequently Asked Questions

How fast can you issue a certificate of insurance (COI)?

Most certificates of insurance are issued within 24 hours, often same-day for existing clients. We understand contractors and businesses need COIs fast for job sites and contracts.

What discounts are available if we bundle home and auto?

Bundling home and auto insurance typically saves 15-25% on your premiums. We shop multiple carriers to find you the best bundle discount available.

When should I enroll in Medicare to avoid penalties?

You should enroll during your Initial Enrollment Period (3 months before your 65th birthday month, your birthday month, and 3 months after). Missing this window can result in permanent premium penalties.

Do I need commercial auto insurance for my business vehicles?

Yes, if you use vehicles for business purposes (transporting goods, equipment, or clients), you need commercial auto insurance. Personal auto policies typically exclude business use.

What's the difference between an insurance broker and an agent?

As an independent insurance agency, we work with multiple insurance carriers to find you the best coverage at the best price. We work for you, not the insurance company.

How often should I review my insurance policies?

We recommend reviewing your policies annually or whenever you experience a major life change (new home, new vehicle, marriage, new business venture, etc.). Rates and coverage needs change over time.